29 Top Crowdfuding Strategies & Tactics That Work Now

Crowdfunding strategies and tactics have been a hit or miss

kind of affair for fund raisers wanting to crowdfund their venture.

Whether you are launching a crowdfunding campaign now,

or in the future, these 29 points will guide you along the right path.

All these tactics are based on research.

For each tactic you’ll learn not only the ‘what’ but also the more important – ‘why’ and ‘how’.

So let's dive in...

One summer, a director at a private equity firm was particiating

in a panel discussion at a consumer goods conference in New York.

When an entrepreneur posed a question: Where could a young

company with only a few dollars in sales go for money?

The director and his peers on the panel fumbled for a response.

The fact is, most private equity investors and venture capitalists

won’t touch a company until it has crossed a few million in sales.

Anything else is too small to bother with.

The best advice the panel could offer was for the

entrepreneur to tap his credit cards.

“The purpose of the panel was to help entrepreneurs raise

money, but we had no answers,” the director remembers.

This is the case for thousands of ventures which

haven’t reached the million dollar sale threshold.

And this is where crowdfunding can help.

What is Crowdfunding?

Crowdfunding represents an alternative way of funding compared to traditional borrowing.

As a principle, crowdfunding is open to everyone – private persons as well as economic actors.

A group of people, the crowd, financially contributes small amounts to projects, products or ideas. These projects, products or ideas are owned by fundraisers (e.g. entrepreneurs or private persons), seeking for money in order to get their project realized.

Fundraisers search for investors directly or via a specific digital platform, referred to as intermediaries.(Bouncken, R. B., Komorek, M., & Kraus, S., 2015)

Related Resources:

An Unlikely Romance Between a Venture Capital Fund and a Crowdfunding Platform Promises to Shake Up Startup Financing - Catherine Clifford

NOTE: This article contains over 6,522 words. You can download it and refer to it later, if you wish. Just fill-up the fields below and I'll send you a PDF of the full article PLUS a checklist of all the tactics mentioned here.

Crowdfunding Strategy: Convey the right financial picture

Tactic 1: Set a reasonable funding goal

When it comes to funding your venture, setting goals is very tricky.

You need to have a fine balance

between raising enough funds and, at the same time, not asking too much and scaring off potential

investors.

Research by Mart Evers in 2012 (Evers, M. W., Lourenço, C., & Beije, P., 2012) found, after

evaluating the outcomes of over 8807 crowdfunding projects, that 67% projects which were

successful in reaching their funding goals had the average funding goal of a manageable $10,000, or

less.

Smaller funding goals make the project appear manageable, well planned & controlled. It gives a

perception that the project is just as small way away from completion and well within the scope of

the team.

Research shows that projects with smaller funding requirements have even exceeded the threshold

funding required many times over, in some cases by up to 1300%. Having an unrealistic funding goal

tends to puts potential investors off and decreases the number of people who invest.

The funding goal is the heaviest influencer of crowdfunding success. It can be intuitively

understood that funding goal highly correlates with the actual amount raised. It therefore

shows that the model is in fact robust.” (Evers, M. W., Lourenço, C., & Beije, P., 2012)

Unsurprisingly the probability of success of the proponent’s project is negatively affected by

the amount of capital needed to complete the project. (Giudici, G., Guerini, M., & Rossi Lamastra, C.,

2013)

The corollary to this finding is that, the exact opposite is also true -one of the reasons for projects

failing is setting a goal too high. (Steinberg, S. M., & DeMaria, R., 2012)

Related Resource: Regulation A+: Legal Considerations & Policy Recommendations to Support Innovation & Growth in 2016 - Robin Sosnow

Tactic 2: Run All-Or-Nothing campaigns

In the earlier tactic we saw that the funding goal has an influencing effect on the success of a

project. Can the type of model used for funding also have an effect?

For this we looked at 2 different types of models popularly used on various platforms.

These two popular models are:

- All-or-Nothing: This model is also called the “threshold pledge model”. In this model the

fundraiser gets the money if, and only if, the funding threshold is reached or exceeded.

- Keep-it-All: In this model the fundraiser gets the money regardless of whether the funding

goal is reached.

For an entrepreneur, the Keep-it-All model may appear to be more attractive since there’s a chance

of his getting some funding, however small it may be.

But, for the investors, this is perceived to be risky as there’s a chance that the project gets

underfunded and the entrepreneurs cannot fulfil their obligations to the investors. The risk of

defaults increases manyfold.

(Cumming, Leboeuf, and Swienbacher, 2014) studied over 47,139 campaigns from the crowdfunding

platform IndieGoGo and found that most entrepreneurs opted for the Keep-it-All model, but the

projects that got the most funding were those that used the All-or-Nothing model.

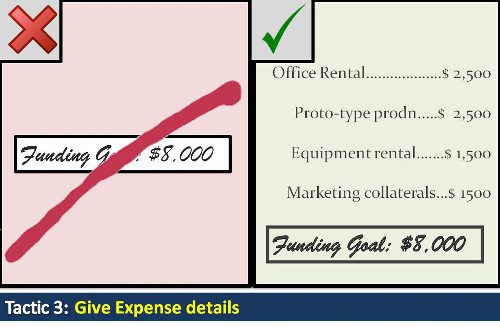

Tactic 3: Give details of expense heads

The human psychology works such that when you give money to someone you always worry about it

is being used for the right purpose. Depending on a person’s comfort level with this uncertainty

s/he, either donates freely or doesn’t.

You can use this piece of information while crafting your crowdfunding strategies and tactics to reduce this mental friction by removing the ambiguity on how the fund is going to be utilised.

(Bekkers and Wiepking 2010) examined the motivation behind people donating to charitable causes.

Among their findings, one primary factor was application of funds. Donors need to feel like their

donation is being put to right use.

“Perceptions of efficacy are related to charitable confidence and perceptions of overhead and

fundraising costs. Donors who have more confidence in charitable organizations think their

contributions are less likely to be spent on fundraising costs and overhead. Such beliefs about

the efficacy of charitable organizations are likely to promote giving.” (Bekkers and Wiepking, 2010)

In practice, however, we find that fundraisers give an aggregated funding goal. While this increases

conceptual fluency and makes it easier to comprehend, it scores low on the perception of efficacy,

thus reducing the chances of raising funds successfully.

Tactic 4: Present financial projections

In the previous tactic we said that giving a break-up of how the fund is going to be utilised helps raise investor confidence and thus, funding success.

This tactic talks about going a step further and giving financial projects of where the company is going to be in the next one, three and five years.

Researchers, of crowdfunding strategies, in this study took two particular cases of crowdfunding projects, one in December 2011 by The Rushmore Group, a start-up which operates 3 bars in London and the other in April

2012 by Meatballs, another owner and operator of a London bar.

The Rushmore Group offered a 10% stake in its operation at £1 mn (GBP) and the other offered 25%

stake for £300,000(GBP).

What happened next was shocking!

While The Rushmore Group managed to raise the full amount within 2 weeks, the Meatballs project

ran for over 2 months and managed to raise only £4,750.

Why, then, did the equity offering of The Rushmore Group succeed while that of Meatballs

failed?

Giving the investors the complete financial picture helps reduce the perceived uncertainty among

investors. The investors are concerned about the rightful application of their money and the reward

they would be getting out of their funding. A financial projection gives them a roadmap of the

project and where they can expect to be in the desired time-frame. This increases the likelihood of

success. (Ahlers, Gerrit, KC et al, 2015)

Entrepreneurs use the prospectus to provide financial forecasts or projections to potential investors, such as detailed earnings forecasts and/or a disclaimer in which they summarize and explain potential risk factors.

If entrepreneurs include neither financial forecasts nor a disclaimer then potential investors are left with a higher level of uncertainty compared to campaigns in which financial forecasts and disclaimers are provided. (Ahlers, Gerrit KC, et al. “Signaling in equity crowdfunding.” Entrepreneurship Theory and Practice, 2015).

Tactic 5: Adjust Request Sizes

In tactic # 1 we have seen that the funding goal is a major influence on the project success.

In this tactic we are going to see how the size of requests affects the success of the project.

Does requesting small token request ($1) really help in reaching the funding goal of, say, $ 5000?

Unfortunately, yes. You’ll trigger a more favourable response from potential investors by requesting

smaller, seemingly insignificant amounts. (Evers, M. W., Lourenço, C., & Beije, P., 2012).

For a reluctant investor token help is a modest contribution to either let the solicitation go away or

decrease the personal distress of not helping at all. If only a small amount is requested, the potential

donor is less likely to argue that he cannot afford to donate.

Signalling token help increases success by anchoring the token amount. Of the 8807 projects studied

93% projects were found to have used signalling token.

However, that’s not always the case. This only works when the token amounts are set in relation to the funding goal.

The funding goal shouldn’t be disproportionately high to the signalled token amount.

E.g. Showing a lowest anchor point of $5 at a project with a goal of $5,000 goal is considered to have a greater influence on success than showing a lowest anchor point of $5 at a project with a $50,000 goal. (Evers, M. W., Lourenço, C., & Beije, P., 2012).

Requesting smaller token help also offers decisional control to the investors.

The investor feels s/he has freedom to choose and, therefore, has more control in the process. The perception that an

experience or outcome is caused by one’s own decision will positively affect emotion and result in more positive psychological and behavioral outcomes.

This increases their chances of investing in your project.

Signalling token helping does have a positive effect on success… this however, is only valid when the actual anchor point of the token amount is set in relation to the funding goal. (Evers, M. W., Lourenço, C., & Beije, P., 2012)

Crowdfunding Strategies: Decrease Perceived Risk

Tactic 6: Go with a crowdfunding platform

Using a crowdfunding platform assures the investors that preliminary due-diligence has been carried out on the project and the people behind it.

When the rate of defaults is high, the investors need to know that their interests will be protected. (Gerber, E. M., Hui, J. S., & Kuo, P. Y. 2012)

In addition to decreasing the perceived risk, using a crowdfunding platform also helps you leverage on their vast experience.

As most project initiators go through a crowdfunding process only once or only a few times in their lifetime, it is very unlikely they will gain the experience and professionalism that crowdfunding platforms develop through their routine work. (Hemer, J., 2011)

Know which platform is the best crowdfunding platform for your needs with this quick post.

Related Resources:

Should You Consider Hiring a Crowdfunding Consultant? – Kendall Almerico

Tactic 7: Offer warranties

Crowdfunding trends show that over 75% projects get delayed (Ethan Mollick, 2014), investors are,

thus, a bit apprehensive of investing in unknown new projects. Offering warranties is one way to reduce this perceived risk. (Chang, J. W., 2015)

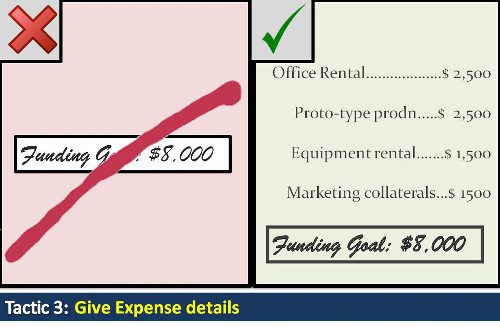

Tactic 8: Do not incentivize the Group Leader

Some platforms offer group bidding. In such cases, usually the group leader is rewarded for initiating the bidding process.

When a group leader bids / invests in a project, it creates an impression that the project has credibility and is of high quality.

While this may seem enticing, in reality, research has found that such project have high default rates leading investors to distrust such projects eventually.

Therefore, in the case where the Group Leader has been incentivised, the group members tend to be wary of investing in the projects, and, if they do invest, the lending is at a higher rate of interest (Hildebrand, T., Puri, M., & Rocholl, J., 2013).

It, therefore, makes sense NOT to incentivise the Group Leader where bidding takes place in a group.

Crowdfunding Strategy: Appeal to their Altruistic side

After everything is said and done, investing in a crowdfunded project is a type of solicitation, and all

types of solicitations are influenced by the similar human motivations.

Tactic 9: Highlight the creative details of your project

It is easier to succeed with a new creative idea than with a slightly better version of an existing idea.

Investors know this and, therefore, are more open to investing in new creative projects.

Creative projects get more successfully funded than even projects that are for good causes. (Evers,

M. W., Lourenço, C. & Beije, P., 2012)

One of the drivers of crowdfunding success is the perceived “cause of need”.

If the reason for raising funds is caused by an external uncontrollable factor, the need is perceived to be bigger than

when the need is caused by someone’s own actions.

Such situations trigger an empathic response.

Now, we know that most crowdfunding projects are not caused by external factors, but caused by

the entrepreneurs own ideas.

Having a creative component indicates that the fundraiser caused his need because of an uncontrollable external factor (problem that needed to be solved).

In such cases, the need is perceived to be bigger and triggers an empathic response (Griffin et al, 1993), thus increasing the chances of successful funding. (Evers, M. W., Lourenço, C. & Beije, P., 2012)

Creative project need not mean only movies, art or theatre. The creative part could be an innovative

technology, software or service, which is attractive to people who are enthusiastic about this

subject. (Hemer, J., 2011)

…an attractive product is the driver of virality with an active community of backers; the success of

the launch gets media attention, a high number of comments, and brings additional fans to the

project in addition to the potential customers. (Kraus, S., Richter, C., Brem, A., Chang, M. L., &

Cheng, C. F., 2016)

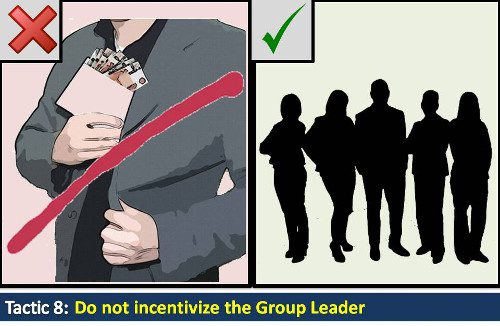

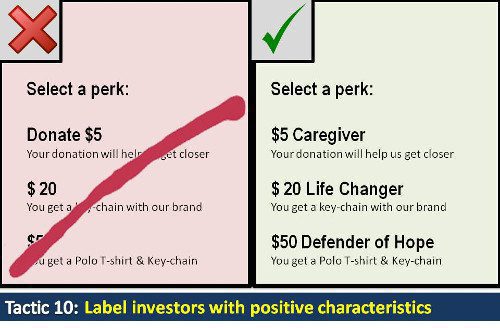

Tactic 10: Label Potential Investors as possessing positive characteristics

As kids we have been told not to call people names…this, however, is one tactic which might help

you reach your goal by doing just that.

When you label your potential investors with positive characteristics associated with helping people

like; generous, kind, helpful, etc. it is supposed to lead to increase in such helpful behaviour. (Evers,

M. W., Lourenço, C. & Beije, P., 2012)

Why does this work? When you label a person with a positive characteristic you are actually applying

the principle of consistent behaviour.

The Principle of Consistent Behaviour states that when you person identifies himself with an identity; he is committed to behave in a manner consistent with that identity, even if that identity is a newly acquired one.

Where to use these labels? Successful crowdfunding strategies have used this tactic by using these positive

characteristics in the Category name, Rewards / Perks and Description field of the project.

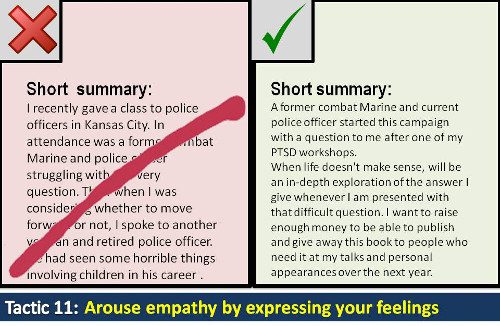

Tactic 11: Arouse empathy by expressing your feelings

For most people investing is a rational as well as an emotional decision.

When the investor, the entrepreneur and the project are separated by great distances, it is, but, natural that, some

emotional overtones would affect the investment decision.

Research shows that, along with the overview of the project, if you give the personal perspective of the beneficiary the chances of the project becoming successful increase. (Evers, M. W., Lourenço, C., & Beije, P., 2012)

A positive effect is generated when the solicitor emphasizes how the beneficiary must be feeling.

Research, into charitable behaviour in individuals, indicates that when a message stimulates people to take other than one self’s perspective, one will show congruent emotional reactions.

Therefore, when someone takes the perspective of a person in need, empathic emotions are aroused and the

motivation to help rises (Coke et al. 1978, Dovidio et al. 1990).

Most entrepreneurs, however, focus more on the project details and the desired outcomes. It helps

to understand that in a crowdfunding scenario, the investors don’t know your project. They are

investing in Y-O-U. It helps if you expose your human side to the investors.

Crowdfunding Strategy: Increase your credibility

Let’s face it, for all practical purposes you are a stranger for your investors.

They don’t know from the next guy.

Before investing in your project, the potential investors would like to make sure that you are who you say you are and that you and your team are capable enough to pull-off the project.

Because the distance and the shortage of time are detriments, the investors have to depend on certain heuristics to come to a decision about you and your credibility. These are some of the heuristics that they depend on.

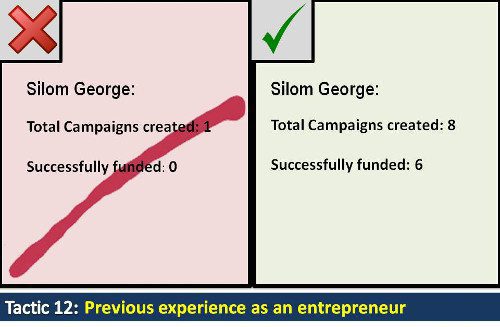

Tactic 12: Communicate your previous experience as entrepreneurs

Like an employer asking you about your employment history to ensure that you are experienced in

your field, the potential investors also check your previous experiences.

Like an employer asking you about your employment history to ensure that you are experienced in

your field, the potential investors also check your previous experiences.

Investors often consider previous successful experiences by the entrepreneur, senior executives

on the founding team, (Hsu, 2007) (Agrawal, A. K., Catalini, C., & Goldfarb, A., 2013)

Tactic 13: Donate to other projects as well

Crowdfunding is a two-way street- you take, but you also need to give it forward. Help and be

helped is the motto of the world and definitely so in crowdfunding. If you have funded other

projects, it conveys that you have faith in the system and aren’t averse to putting a bit of your skin in

the game.

Researchers at the École des Hautes Études, Montreal, studied 875 projects in 2011 which found that the total amounts raised are positively influenced by participation of entrepreneurs in the crowdfunding of other projects. (Boeuf, B., Darveau, J. & Legoux, R., 2014)

When entrepreneurs are themselves backing other projects the prosocial effect of the phenomenon is reinforced. Reciprocity also plays it part ( Muniz & O’Guinn, 2001) (Boeuf, B., Darveau, J. & Legoux, R., 2014)

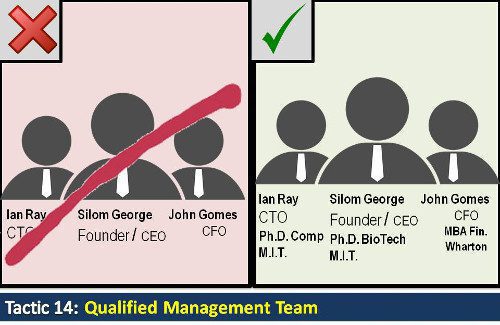

Tactic 14: Convey post-graduate qualification of the management team

In terms of crowdfunding tactics, the level of education (e.g., share of executives with an MBA degree or

founders with a doctoral qualification), has been shown to be positively correlated with successful

fundraising (Ahlers et al, 2012) and (Agrawal, A. K., Catalini, C. & Goldfarb, A., 2013).

This isn’t very different from what VC and Seed Funds look for in a management team of a potential

project.

Founders with doctoral degrees as useful signals of quality (Hsu, 2007) (Agrawal, A. K., Catalini, C., &

Goldfarb, A., 2013)

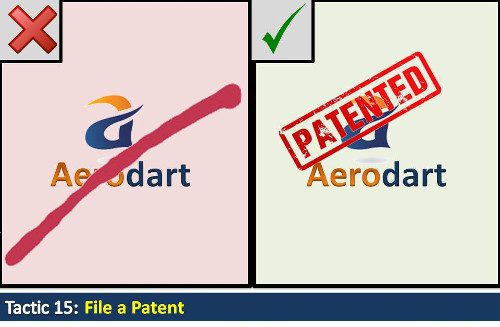

Tactic 15: File a Patent to improve success rate

Having a creative project and a unique idea ensures that yours is not a me-too project entering into

an already crowded market.

But, having filed a patent on your processes or better still your technology ensures that there won’t be many other me-too's of your business in a hurry.

This improves your chances of getting successfully funded.

This shows that you have done the groundwork to protect your project and that you have skin in the business, too. It improves the credibility of your venture.

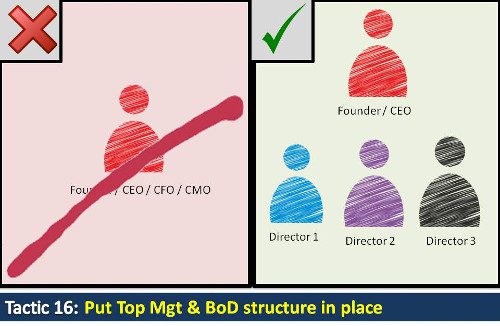

Tactic 16: Put your internal governance in place

Every organization needs a board to guide them on the way forward and, at times, also afford them

the access to their wisdom & contacts.

Having a structured board in place with highly qualified members’ increases investor confidence in

your company and, thus your project.

This increases the likelihood of attracting funding making it one of the crowdfunding strategies you cannot afford to ignore. (Ahlers, G.K., Cumming, D., Günther, C. & Schweizer, D. , 2015)

…internal governance, such as, e.g., proper board structure and more highly qualified

board members, can enhance the likelihood of attracting investors and the speed of

capital-raising. (Ahlers, G. K., Cumming, D., Günther, C., & Schweizer, D. , 2015)

Tactic 17: Incorporate a company

How do you know if this is one of the good crowdfunding strategies?

See for yourself… which entity evokes more trust?

- ABC ‘s Workshop

- Nero CleanServe Inc.

Incorporating a company could prove as a signal of reduced risk to investors. Higher goal

achievement, pledge goals, amount of backers and backer feedback seem to have a positive

influence on company foundation. (Brüntje, D., Joenssen, D. W., Gossel, B. M., Müllerleile, T., &

Brehm, M. )

Tactic 18: Offer meaningful rewards

Reward-based campaigns have quickly become the dominant type of crowdfunding all over the

world. In 2012, 14% of funding volumes were reward-based, compared to 4% of equity-based

crowdfunding (Wilson & Testoni, 2014). Rewards can be in many different forms and types. Be

creative with your rewards.

We even find rewards can be the key for success…( Kraus, S., Richter, C., Brem, A., Chang, M. L., &

Cheng, C. F., 2016)

When it comes to incentives, we can support Steinberg (2012) and Colombo et al. (2015) who identify incentives as the key elements of a successful crowdfunding project. (Kraus, S., Richter, C., Brem, A., Chang, M. L., & Cheng, C. F., 2016).

Offering unique and meaning rewards need not be too difficult. Here are a few examples:

The product itself

- Enhanced versions of the product. For instance, autographed, deluxe, director’s cut and

collector’s editions. - Merchandise and souvenirs: Commemorative posters, stickers, t-shirts, caps and other items

- Behind-the-scenes photos, videos and booklets. Items that show the people, concept work

and other elements featured within the project - Opportunities to affect the project’s eventual outcome. Allow backers at certain levels to

suggest how stories develop, what’s included in the finished package, and featured subjects

or locations. - Making your backers part of the product. Some creative projects allow backers at certain

levels to be a character within the narrative, soundtrack or action itself. - Giving contributors credit. There are ways to do so publicly, within the product itself (ex.

within the liner notes, or book or game credits) or at surrounding events via mentions over a

microphone or banners/signs specifically thanking especially generous donors. - Combined rewards. Rewards that combine several other rewards into one, or bundle several

pricing tiers worth of incentives’ together. - Exclusive access. Chances to meet people who are part of the creative team behind various

projects, or related notables. - Private parties, events and occasions. Some projects offer special events as a reward to

donors.

Tactic 19: Introduce your team

A successful business is a team sport not an individual one.

A good team will make or break you business. Put in the time and effort to build a great team, and, once you have it- flaunt it.

A good team has members whose skill-sets complement each other. Their total is more than the sum of

their parts, and thus they build an incredible business.

Create constant updates about optimization, news, innovation, experiences, and feedbacks – the

crowd will show their appreciation for improvements and a consistent work ethic via their funding.

(Kraus, S., Richter, C., Brem, A., Chang, M. L., & Cheng, C. F., 2016)

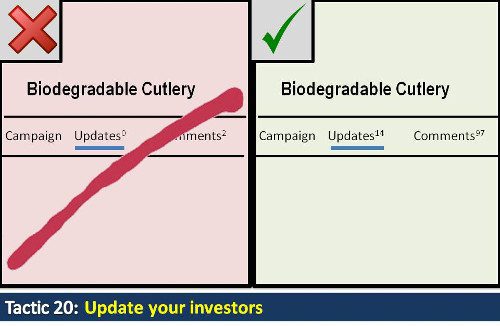

Tactic 20: Keep your investors updated

Once the funding has been initiated, the investors are bound to have queries and may also have buyer’s remorse.

To keep the faith intact, it is necessary to reassure them that things are under control and that they have made the right decision by investing in your project and they can expect to get their deliveries in time.

Regular updates on the progress of your project serves as an assurance that you mean business and

that things are going as planned, or, if they are delayed, that you are taking steps to avoid them in

the future.

Create constant updates about optimization, news, innovation, experiences, and feedbacks – the

crowd will show their appreciation for improvements and a consistent work ethic via their funding.

(Kraus, S., Richter, C., Brem, A., Chang, M. L., & Cheng, C. F., 2016)

Tactic 21: Point out other similar winning projects

Social proof is a very strong motivator when it comes to raising funds.

Projects similar to yours which have successfully raised funds and executed them with due expertise serve as a proof that it’s possible to do the same again.

Investors are influenced by the success or failure of related projects and use the actions of other

investors as a source of information in their funding decisions. (Ward, C., & Ramachandran, V., 2010)

It, therefore, makes sense that you point out such projects in the past which have paved the way for your project to follow.

Crowdfunding Strategy: Put your Marketing in Place

It’s not enough to have a great business idea and a great business plan, if no one knows about it.

You may have the best product idea along with a great manufacturing process, but unless the potential

investors know about it, no one is going to fund it.

You marketing plan achieves that for you.

Tactic 22: Prepare a concise pitch

Given the shrinking of attention spans in humans, it is but obvious that, no one has the time to read

pages of text anymore.

It is imperative that you prepare a concise pitch which grabs their attention within 10 secs and

delivers your message and call-to-action within 2 mins.

Anything longer than this loses the interest of the viewers, thereby reducing the chances of attracting funding

Word count has a negative effect on success. (Evers, M. W., Lourenço, C., & Beije, P., 2012)

One study found that a successful pitch had, on average 577 words.

What should you focus on in your pitch – the business idea, or, the management team?

Our findings indicate that technology projects tend to focus more on the business idea, whereas the

artistic projects are focused on the personage of the entrepreneur.

Tactic 23: Use images in your pitch

They say a picture is worth a 1000 words. We don’t know the accuracy of such a statement.

How do you quantify something like that?

Now, regardless of the worth of a picture in terms of number of words, one this is certain, and that is

when it comes to crowdfunding, images with your project pitch significantly increases the number of

investors.

Boef et al. (2014) as well as Colombo et al. (2015) point out that a picture of the project owner also

boosts the probability of successful projects. Many project owners have started using this in their crowdfunding strategies and tactics lately.

Having 3, or more images, in your pitch increases the chances of success by up to 50% (Evers, M. W.,

Lourenço, C., & Beije, P., 2012).

Tactic 24: Use video in your pitch

If a picture is worth a 1000 words, then a video is equal to 10000 words.

Wheat et al. (2013) and Mollick (2014) found the lack of a video to be negatively related to

crowdfunding success.

You should grab the viewer’s attention in the first 10 seconds and keep things brisk and engaging –

upwards of two minutes is pushing it for overall length, given shortened online attention spans.

(Steinberg, S. M., & DeMaria, R., 2012)

Related Resource

- https://youtu.be/jnnJGaMpR9o – Hassan Pinto

Tactic 25: Keep your potential investors engaged in a conversation

One of the motivators for investors to participate on crowdfunding platform is to be able to engage in a community.

This way they feel like they are involved or engaged in the project throughout the duration. (Ward, C., & Ramachandran, V., 2010)

By inviting and addressing questions and posting regular updates, creators maintain supporter relations and uphold a reputation as a responsible and accessible project creator. (Hui, J. S., Gerber,

E., & Greenberg, M. (2012)

E.g. A creator of a game project described how he utilized this in his crowdfunding strategies and updated his supporters to keep them informed on progress:

“I will make sure that I send updates on how it's going… I'm able to share real time videos of how I

lay out a book design, and so I can share the process as it goes through.

The backers appreciate that, and that seems to kind of build up trust that I can fulfil on these projects, which is one big question mark early on.”

Engagement is the second most influential variable of success and the number of comments is an

indication of social influence.

It should come as no surprise that creating engagement with donors is essential in bringing a crowdfunding project to a successful end. Research by Mart Evers found that the tipping point of a project to reach its funding goal is 21 comments. (Evers, M. W., Lourenço, C., & Beije, P., 2012)

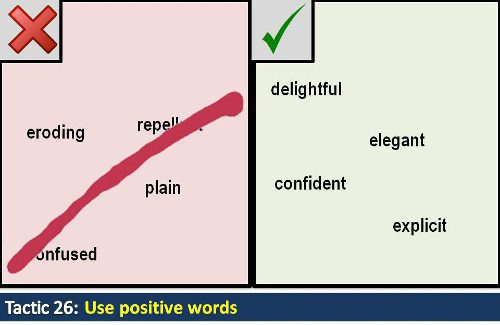

Tactic 26: Use positive sentiments in your pitch write-up

Project success is directly associated with a short but positive project pitch. (Evers, M. W., Lourenço,

C., & Beije, P., 2012). Communicating your project details in a positive and enthusiastic manner lets

viewers know: Why are you passionate about projects, and why should they be as well.

Crowd investors prefer high levels of positive language patterns and moderate levels of promoting

innovativeness. (Lins, E., Fietkiewicz, K. J., & Lutz, E. (2016).

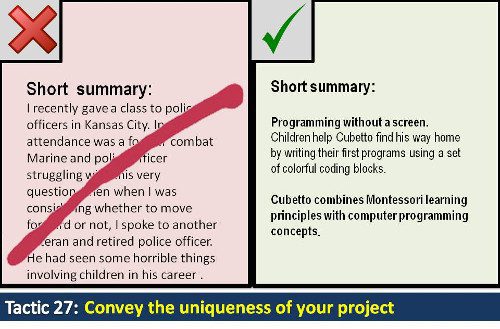

Tactic 27: Communicate the uniqueness in your project

“To improve chances of success, you want to build a project or product where you think you’re filling

a hole.

Part of the trick is showing people things that they either a) haven’t seen in a long time or b)

things they haven’t seen before.” -Brian Fargo, Wasteland 2

According to (Steinberg, S. M., & DeMaria, R., 2012) Lack of differentiation and the inability to define

and communicate unique sales points is one of the major reason projects fail to reach funding goals.

We further find strong evidence that the promotion of a project’s innovative aspects increase the likelihood of convincing the crowd to provide funding.

This finding works up to a certain point where this promotional effect will reverse and decreases the likelihood of funding success (Lins, E., Fietkiewicz, K. J., & Lutz, E. (2016).

If the project appears to be too unique, it implies a level of uncertainty and creates room for doubting the market-readiness for such a project.

Related Resource: 5 Lessons from $1 mn worth of crowdfunding – Salvadore Briggman

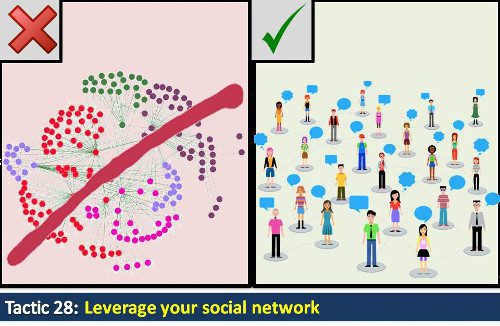

Tactic 28: Have more social network friends

Individual social capital (ISC- large network of personal contacts) has a significant and positive effect

on the probability of reaching the target funding. (Giudici, G., Guerini, M., & Rossi Lamastra, C.,

2013)

Preliminary results show that individual social capital (ISC) has a significant and positive

impact on the probability to reach the target funding (this supporting that in a context of

information asymmetry ISC signals the good quality of a project) (Giudici, G., Guerini, M., &

Rossi Lamastra, C., 2013)

….examining the results of the social networks analysis we concluded that successful initiators

have more friends but a sparser network. Unsuccessful entrepreneurs, on the other hand,

have a higher average degree suggesting a denser network. (Hekman, E., & Brussee, R., 2013)

In addition to asking for donations, creators ask their personal network to employ viral marketing

strategies of spreading the work. If you are thinking of crowdfunding real estate this post is for you!

In Conclusion

Did you skip immediately to this conclusion? No worries.

I’m guessing you want the main take-aways without trudging through the whole article.

If so, you’ll love this check-list, which not only provides a ready-reckoner of all the tactics but also serves

as a swipe-file of sorts.

You can get it here for free.

Did you wade through the entire article? Then you’re a brave soul, my friend.

And you deserve a paton the back. I spent a ton of time researching and writing so I hope you found the insights helpful.

Before parting ways let’s look at one final tactic.

Instead of reiterating all the tactics, I want to end with one final and most important tactic in this list.

If you have trouble getting backers for your project- even after implementing the crowdfunding strategies and tactics we discussed in this article- then you might not have a crowdfunding problem.

You might have a problem conceptualizing and communicating the value proposition of your project.

Instead of focusing on a new tactic, try adjusting your pitch to better convey your value proposition.

- What makes your project special?

- How is it better than the options available in the market today?

- Why would customers enjoy it?

With this tactic – and all the of the other crowdfunding tactics in this article, you should be able to find you project much more easily.